Disclaimer: Please use this channel at your own discretion. These articles are contributed by our users. SeattleIndian (BroadLink, LLC) is not responsible or liable for any problems related to the utilization of information

of these articles.

| Latest Articles |

|

"Shankara" - A Spiritual Ode to Lord Shiva: Actor Mithun Purandare Takes Center Stage

(Press Release)

Embark on a celestial journey as the soul-stirring strains of "Shankara" reverberate through the cosmos, offering a spiritual homage to the divine lord of creation and destruction, Shiva. Led by the v...

Staff

|

|

Designer Archana Kochhar appointed as the Official Indian Fashion Designer for the 71st Miss World

(Press Release)

The Miss World competition is happening in India after 28 years and Renowned Fashion Designer Archana Kochhar has been Appointed as the Official Fashion Designer for this mega event. Archana who has b...

Staff

|

|

San Jose Resident Travels to D.C. to Urge Congress to Ensure Childhood Cancer Research Remains a National Priority

(Community News)

San Jose, Calif. – February 19, 2024 – San Jose resident and American Cancer Society Cancer Action Network (ACS CAN) volunteer Sarva Channarajurs traveled to Washington, D.C., on February 13 to share ...

Priscilla Cabral

|

|

Discover Proven Strategies for Healthy Living Today

(Health & Lifestyle)

In the hustle and bustle of our daily lives, we often neglect the most important aspect that keeps us going: our health. This article from IndianLoop.com highlights everyday strategies for healthy liv...

Anya Willis

|

|

4 Healthy Ways to Help You Maintain Your Sobriety

(Health & Lifestyle)

Swapping bad habits for healthy ones will help you stay clean and sober. From morning to night, there are easy strategies you can put in place to help you maintain your sobriety. Here, IndianLoop...

Anya Willis

|

|

Akshay Kumar unveils New BTS Video for "Bade Miyan Chote Miyan

(Press Release)

International megastar Akshay Kumar recently shared a thrilling behind-the-scenes video, showcasing Tiger Shroff and him in action-packed sequences.Directed by Ali Abbas Zafar, "Bade Miyan Cho...

Staff

|

|

Akshay Kumar Unveils Soul-Stirring Music Video "Shambhu" Dedicated to Lord Shiva

(Press Release)

International megastar Akshay Kumar takes centre stage in the newly released music video, "Shambhu," a visual and auditory spectacle that pays homage to Lord Mahadev. The music video, which premiered ...

Staff

|

|

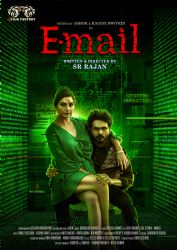

Actor Ashok Kumar Balakrishna #AKB Marks 23rd Film Milestone in 'EMAIL' - A Gripping Action Thriller

(Press Release)

Tamil actor Ashok Kumar Balakrishna, also known as 'Murugaa' ASHOK, is set to make his 23rd appearance in the Tamil film industry with the upcoming Action Thriller, "EMAIL," directed by Mr. SR Rajan. ...

Staff

|

|

Renowned actress Madhu Chandhocknew song "Maiye" Released

(Press Release)

Renowned actress Madhu Chandhock is set to captivate audiences once again, this time with the launch of her latest Punjabi song titled "Maiye". The much-anticipated release promises to enchant listene...

Staff

|

|

Akshay Kumar shares Bade Miyan Chita Miyan teaser, releasing on Eid 2024

(Press Release)

The much-anticipated teaser of the action thriller film "Bade Miyan Chote Miyan" was officially released by the makers and cast on Wednesday, offering a thrilling glimpse into the dynamic world of esp...

Staff

|